Report on Operations

Customer Services

Customers are looked after by Customer Services teams at the Communication Centre, who are responsible for the administration of insurance contracts (i.e. underwriting, checks, entry in the administration system, and amendments), payment processing and claim settlements.

One of Česká pojišťovna’s strategic objectives is to increase customer satisfaction with the services rendered. The customer satisfaction index, used to obtain customer feedback on a rolling basis, increased in 2014 by four percentage points, and is of the standard expected of a mature financial institution.

Besides activities geared towards enhancing customer satisfaction, the main claim settlement themes in 2014 centred on the implementation of the new Civil Code and the advanced management of indemnity costs.

One of the Company-wide customer satisfaction activities was a project to simplify and speed up settlement processes in certain segments of property claims and to improve communications. We are also developing technological support for electronic inspections in response to property and agricultural claims.

In the settlement of motor insurance claims, we focused on nurturing cooperation with vehicle dealers and service centres, windscreen fitters and car rental companies. We successfully established new market-wide methodology to ensure the objectivity of paintwork costs. In the realm of MTPL, we were compelled to adopt measures reflecting the new Civil Code while minimising the adverse effect on the profitability of this insurance.

In personal liability insurance, we registered a rise in claims relating to electronics, mobile phones and tablets, and adapted our settlement process accordingly.

We also made significant headway in insurance fraud prevention, introducing new methods to identify potential fraud based on predictive models and analyses of social networks.

In our insurance and payment administration, we continued the trend of computerisation and simplification in 2014, including searches for the best Generali Group solutions in a bid to offer our clients new, high-quality and fast services. During the year, for example, we successfully pilot tested the biometric signing of documents and subsequent electronic delivery thereof to customers at selected branches of Česká pojišťovna. In terms of payments, we introduced express claim settlement for clients, accompanied by new payment opportunities in the form of electronic banking. The workload intensified considerably at the end of the year as we dealt with an amendment to tax legislation, resulting in the processing of record numbers of requirements from customers and business partners with no deterioration in the quality of service.

Communication with customers in 2014 benefited from more active use of electronic media. The Customer Zone, which provides an overview of contracted insurance products, allows for correspondence to be received via secure internet access, and, more recently, facilitates downloads of documents related to insurance contracts and claims, is now used by more than 200,000 customers.

Numerous changes and new services were also introduced in 2014, including newly configured collaboration with the Financial Arbitrator and the Czech Insurers’ Bureau. We were the first insurance company to start transmitting data to the Czech Insurance Association under the REDOZ project.

In 2014, Communication Centre operators fielded 1.2 million incoming calls and processed 1.6 million electronic and paper documents. In addition to handling service requests, the Communication Centre also engaged in telephone sales of policies and the active retention of existing clients. We successfully expanded the services offered by the Communication Centre at night time and on non-working days to include the telephone registration of non-life insurance claims. We significantly speeded up the response time to clients’ email enquiries and introduced a new callback system for operators to contact clients at times precisely agreed in advance.

The Customer Services Department is also responsible for handling customer complaints, which are dealt with by a specialised team. We focused on better, faster communication with our customers. We now make more widespread use of telephone calls to resolve complaints as customers find this more convenient. Another positive change has been the full-on approach to clients, where we do not just deal with a specific complaint, but also ensure customers’ overall satisfaction with Česká pojišťovna.

By enhancing service quality and efficiency, the various Customer Services units made a sizeable contribution to the overall earnings result reported by Česká pojišťovna.

Investment Policy

Financial investments stand alongside insurance and reinsurance as another important area of operations for the Company. They contribute significantly to overall Company assets and are financed primarily from technical provisions (for this reason, they are sometimes referred to as “financial placements of technical provisions”), as well as from equity. Financial placements of technical provisions account for 92% of overall financial investments, with the remaining eight per cent financed from other sources.

Requirements regarding the structure of financial placements of technical provisions are set out in Implementing Decree No 434/2009 implementing certain provisions of the Insurance Act (Act No 277/2009). That decree regulates the structure of a substantial portion of financial investments through a system of limits. Česká pojišťovna reflects these limits in its internal policies and procedures by means of internal regulations with the aim of achieving safety, liquidity and profitability in order to ensure that the Company is always capable of meeting its commitments to customers.

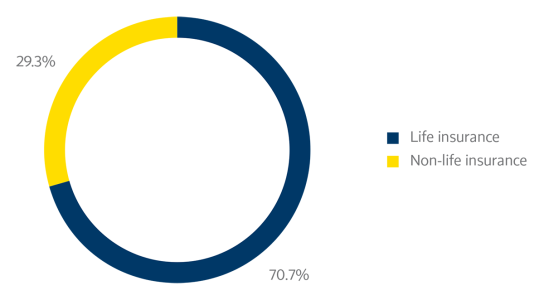

The structure and volume of the Company’s financial investments as at 31 December 2014 are shown in the graph and table entitled “Structure of Financial Investments (IFRS, Book Value), by Business Segment”.

Structure of Financial Investments (IFRS, Book Value), by Business Segment

The 2014 gross investment result before adjustment for portfolio management fees was a profit of CZK 2.4 billion.

The global economy will continue its slow growth in 2015, but specific trends will differ by country and region on a much larger scale than we have witnessed so far. While the US is enjoying growth built on solid foundations, with the Fed likely to stop propping up the economy with quantity easing and make its first foray into interest-rate hikes, growth in Europe remains muted and deflation is the main threat to any further recovery. With current rates at zero, the ECB will combat deflation with a programme of purchasing government and other bonds. Low oil prices and the weakening euro could also play a positive role in Europe’s growth. The economic situation in Central Europe is good. The countries here are reporting solid growth that, so far, has avoided inflationary pressures. In the Czech Republic, currency and fiscal policies will have a pro-growth effect. In 2015, the Czech National Bank will continue to suppress the crown. Forecast economic developments and other factors exercise an influence over the direction taken by investment strategy. Of the risk asset classes, which should complement the safe debt securities in the portfolio, corporate bonds remain an attractive proposition this year. Česká pojišťovna is also planning further investment in real estate and is guiding its securities trading operations primarily into shares which pay out regular dividends. All of the above types of investment offer an alternative to bonds and are a means of increasing portfolio yields at a time of extremely low interest rates.

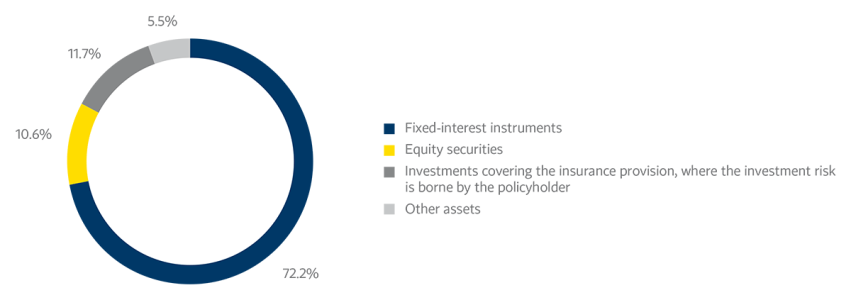

Financial Investments within the Life Insurance Segment

At the end of 2014, the life insurance segment contained a total of CZK 63.1 billion in financial investments. Of this amount, CZK 7.4 billion (11.7%) comprised investments covering provisions for policies where the investment risk is borne by the policyholder. This is a reduction compared to the previous year, prompted by the maturity of two tranches of single-premium Garance insurance in December 2014. In the segment of regular-premium insurance, unit-linked life insurance continues to account for most newly concluded contracts, which means that the share of the corresponding provisions in overall life insurance provisions will continue to rise in the future. The remaining financial investments in the life segment are financed by conventional life insurance provisions and by a portion of the Company’s own equity allocated to this segment. For the most part, this money is invested in fixed-income instruments (CZK 45.5 billion), consisting mainly of debt securities (CZK 45.1 billion), especially Czech and foreign government bonds and corporate bonds of issuers with an investment grade rating, and term deposits at capital-intensive domestic and foreign banks (CZK 1.1 billion).

In accordance with a feature typical for life insurance liabilities, i.e. their longer time frame, debt securities covering life insurance provisions have, on average, longer to maturity. The aim is to safeguard a sufficient and stable yield in the long run that will enable obligations arising from insurance contracts to be met. In terms of accounting classification, 83% of debt securities are classified as available-for-sale financial assets, so as to align the reporting of their result with the method used to account for insurance liabilities, and reduce earnings volatility resulting from changes in market interest rates.

Structure of Financial Investments (IFRS, Book Value), by Life Insurance Business Segment

The second largest group, by volume, in the structure of financial investments comprises equity securities (shares, unit certificates, and other variable-yield securities), accounting for 10.6%, or CZK 6.7 billion in absolute terms, at the end of 2014. These instruments are purchased for the portfolio to act as a counterweight to fixed-interest instruments for purposes of risk diversification and to optimise overall medium and long-term returns.

The investment portfolio is rounded out by other fixed assets. Here, Česká pojišťovna has investments in buildings and land, taking the form of direct ownership of real estate or equity in companies which own the real estate and engage in the management and letting thereof as their core activity. In the past few years, allocations to this investment segment have been steadily growing, and at the end of the year investments here had a book value of CZK 3.5 billion (a share of 5.5%). Against a background of low interest rates, real estate investments are a suitable source of higher, long-term stable yield, and also offer the opportunity of capital gains as the market price of property rises.

The gross return on life financial investments, before the deduction of management fees, was CZK 1.789 billion. Of this amount, investments covering insurance provisions where the risk is borne by the policyholder accounted for CZK 67 million. Interest on debt securities and deposits was the biggest source of returns.

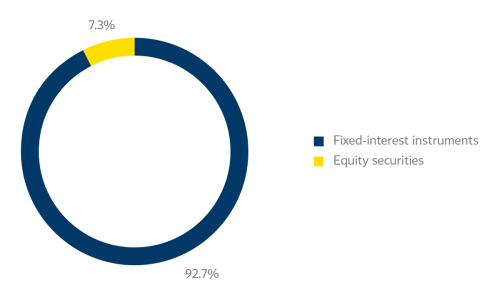

Financial Investments within the Non-life Insurance Segment

Investments in the non-life segment are financed by non-life insurance technical provisions and the equity allocated to this segment. Since non-life liabilities are shorter than life liabilities, there are more assets with shorter times to maturity in the portfolio, as well as more liquid instruments, which can be readily converted into cash when needed to pay insurance claims.

As at 31 December 2014, the book value of the portfolio of non-life insurance was CZK 26.1 billion; 92.7% (CZK 24.2 billion) of the portfolio consisted of fixed-income instruments, of which debt securities had a book value of CZK 19.2 billion, receivables under reverse repo transactions with CNB bills CZK 4.4 billion, and term deposits with banks CZK 988 million. The remaining 7.3% of the portfolio was invested in equity securities. Defined by accounting classification, the overwhelming majority of financial investments are classed as available-for-sale assets.

Structure of Financial Investments (IFRS, Book Value), by Life Non-Insurance Business Segment

The total return on financial investments within the non-life insurance segment, before the deduction of management expenses, was CZK 617 million in 2014. As in the life insurance segment, the biggest contributor to this result was interest income from bonds and term deposits.

Structure of Financial Investments (IFRS, Book Value), by Business Segment

| Life Insurance | Non-life Insurance | |||

|---|---|---|---|---|

| CZK thousands | % | CZK thousands | % | |

| Buildings and land (fixed assets) | 3,451,077 | 5.47 | — | 0.00 |

| Loans | 1,794,516 | 2.84 | 4,457,335 | 17.06 |

| Unlisted debt securities | 885,094 | 1.40 | — | 0.00 |

| Loans and advances provided under repo transactions | — | 0.00 | 4,400,034 | 16.84 |

| Other loans | 909,422 | 1.44 | 57,301 | 0.22 |

| Financial assets available for sale | 44,295,907 | 70.20 | 20,673,108 | 79.13 |

| Debt securities | 37,581,316 | 59.56 | 18,776,364 | 71.87 |

| Shares, unit certificates and other variable-yield securities | 6,714,591 | 10.64 | 1,896,743 | 7.26 |

| Financial assets at fair value through profit or loss | 14,222,256 | 22.55 | 390,545 | 1.49 |

| Debt securities | 6,656,752 | 10.55 | 386,511 | 1.48 |

| Shares, unit certificates and other variable-yield securities | 175 | 0.01 | — | 0.00 |

| Investments covering provisions for policies where the investment risk is borne by the policyholder | 7,403,762 | 11.73 | — | 0.00 |

| Positive market value of derivatives | 161,568 | 0.26 | 4,033 | 0.02 |

| Other investments | 1,074,000 | 1.70 | 987,666 | 3.78 |

| Fixed-term bank deposits (net of reinsurance deposits received) | 1,074,000 | 1.70 | 987,666 | 3.78 |

| Financial liabilities (net of bonds outstanding) | (1,739,581) | (2.76) | (383,243) | (1.47) |

| Loans and advances received under repo transactions | — | 0.00 | — | 0.00 |

| Negative market value of derivatives | (1,739,581) | (2.76) | (383,243) | (1.47) |

| 63,098,175 | 100.00 | 26,125,410 | 100.00 | |

Reinsurance

Česká pojišťovna’s reinsurance programme is a long-term contributor to the Company’s balanced earnings and stability. As a risk management tool, reinsurance protects Česká pojišťovna, along with its customers and shareholders, from unexpected individual or catastrophic events, as well as from random variations in loss frequency. Analyses of reinsurance needs and the optimisation of the reinsurance structure take place using modern dynamic financial analysis tools in collaboration with Holding experts and with the support of reinsurance brokers. Each year, the reinsurance programme is modified by the Holding to ensure that it reflects changes in the portfolio and the product line.

Česká pojišťovna’s principal and obligatory reinsurance partner is the Group’s captive reinsurer, GP Reinsurance EAD, based in Bulgaria. Through GP Reinsurance EAD, risks are further retroceded into the Group’s reinsurance contracts by Assicurazioni Generali. Thanks to this optimisation, Česká pojišťovna can profit from the advantages of Group coverage and thereby further reduce reinsurance costs while expanding coverage terms. Group rules determine the maximum possible exposure that Česká pojišťovna may have to each type of insurance.

Thanks to intensive, painstaking work detailing information on individual risks in the portfolio, Česká pojišťovna is able, through the use of sophisticated models, to control its exposure to catastrophic risks. Currently, flood losses are modelled regularly over the personal lines, commercial lines, and large risks portfolios. Gale exposure is modelled in a similar structure.

Česká pojišťovna is perceived by partners and affiliates as a stable and strong reinsurance partner in its own right. This fact is reflected in the volumes of obligatory and facultative reinsurance in the area of corporate customers and large risks.

Nuclear Pool

The Czech Nuclear Insurance Pool (“CNIP”) is an informal consortium of non-life insurers based on the co-insurance and reinsurance of nuclear risks. It offers insurance and reinsurance services for liability and material risks, including risks related to the transportation of nuclear material.

The CNIP operates both as an insurer of domestic risks and in the area of inwards reinsurance. Due to the unique character of nuclear risks, individual insurance companies do not usually insure them. The insurers in the CNIP each provide their own net lines, the sum of which forms the overall capacity of the CNIP for individual types of insured risks. The CNIP’s overall capacity has not changed in recent years. Česká pojišťovna’s net exposure remained unchanged in 2014. Within the CNIP, an Agreement on the Several Liability of Members for the current year was concluded. Since the CNIP’s inception, Česká pojišťovna a.s. has been the lead co-insurer under an agreement among insurers participating in the pool. The CNIP’s executive body is the CNIP Office, which is part of the Nuclear Pool and Facultative Reinsurance Department within Česká pojišťovna’s organisational structure.

Human Resources

At the end of 2014, employees numbered 4,213, of whom 3,862 were full-time contracted employees and 351 were hired under “agreements on the performance of work” or “agreements on work activities”.

The Company annually refines its core appraisal principles, consisting of an emphasis on positive motivation and the identification and exploitation of the strengths of individuals. The employee development and remuneration systems are linked to the employee appraisal system. Top-rated employees benefit from the most systemic development support.

In employee development, Česká pojišťovna concentrates on strengthening expertise and fostering insurance know-how. We are expanding the involvement of internal trainers in employee training in line with the principle of a self-learning organisation. We are forging ahead with afternoon workshops and with the Insurance Academy (Pojišťovácká akademie), which is particularly important for new colleagues. The chief sponsor of the programme in 2014 was the CFO.

In 2014, we also developed specific programmes for key groups, such as talents, graduates and managers, preparing intensive annual training courses geared towards their professional advancement. Česká pojišťovna makes systematic use of development instruments such as Customer Day (a day spent with a mentor in the front line). This activity will continue in 2014 with a view, in particular, to forging strong bonds between front-line teams and nurturing teamwork.

In an effort to retain key employees and to prevent loss of unique know-how, a scheme aimed at identifying, promoting and retaining employees with unique expertise was prepared. Mobility (Mobilita), a programme designed to broaden career opportunities within the Company and the Generali Group, was also launched.

Building on the results of an employee poll and in an attempt to improve employee care, we are developing benefits in areas that reflect the key lifestyle needs of our employees. One of these areas is health care, with a stress on disease prevention, physical fitness, mental well-being and healthy eating, all wrapped up in the WE FIT programme. Our efforts to deliver an improved working environment and to enhance the health of our employees were rewarded last year with the Health Promoting Enterprise Certificate, awarded by the National Institute of Public Health.