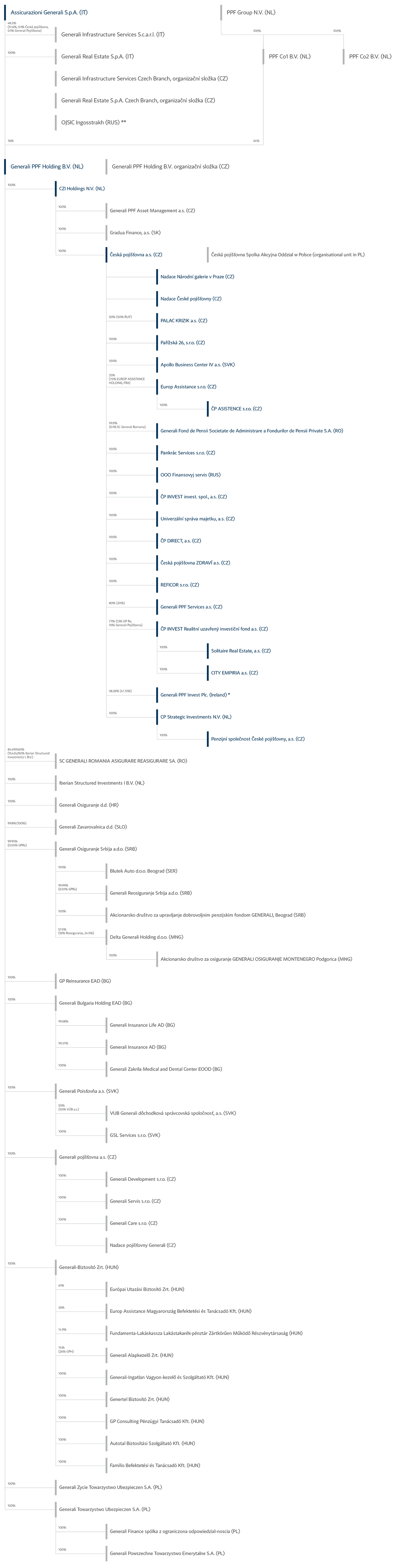

Description of Group Structure, Position of Česká pojišťovna

As at 31 December 2013, Česká pojišťovna was part of a group; the company at the pinnacle of that group’s holding structure is Generali PPF Holding B.V. (renamed Generali CEE Holding B.V. from 16 January 2015; also referred to in the text below as the “Holding”). The ultimate owner of Česká pojišťovna is Assicurazioni Generali S.p.A., which held a 76% stake in the voting rights associated with the shares of Generali PPF Holding B.V. as at 31 December 2014 (the remaining 24% stake, held by PPF Group N.V., was purchased by Assicurazioni Generali S.p.A. as at 16 January 2015). The Company’s sole shareholder is CZI Holdings N.V.

CZI Holdings N.V.

The company compiles a report on related-party transactions in accordance with Section 82 of Act No 90/2012.

Generali PPF Holding B.V. (Generali CEE Holding B.V.)

Generali PPF Holding B.V. (Generali CEE Holding B.V.) directs the business of its subsidiaries through an organisational unit based in Prague, Czech Republic. The Holding has operations not only in the Czech Republic, but also in Slovakia, Poland, Hungary, Romania, Bulgaria, Serbia, Slovenia, Montenegro and Croatia.

Česká pojišťovna Group Structure as at 31 December 2014

The following Group companies were renamed in January 2015:

Generali PPF Holding B.V. was renamed Generali CEE Holding B.V.

Generali PPF Asset Management a.s. was renamed Generali Investments CEE a.s.

Generali PPF Services a.s. was renamed Generali Services CEE a.s.

Generai PPF Invest plc (Ireland) was renamed Generali Invest CEE plc (Ireland).

Nadace České pojišťovny was renamed Nadace GCP.

* Generali PPF Invest (IR) is an open-ended investment company with variable capital and liabilities separetad between the individual sub-funds. The share of Česká pojišťovna a.s. depends on the share of onvestment in each fund. Investments in the funds are reported in the Česká pojišťovna a.s. financial statements as securities available-for-sale hold for sale.

** OJSIC Ingosstrakh (RUS) is an indirect subsidiary Assicurazioni Generali S.p.A.with the direct share of these companies: OOO Invest. Initsiativa 15.854%, OOO Novyi Capital 15.854%, OOO Vega 6.751%.

Description of Selected Companies within the Česká pojišťovna Group

Below we provide information on companies that form part of the Česká pojišťovna Group and are of fundamental importance either for the Company’s business or its capital position. Information on certain other companies that belong to the same group as Česká pojišťovna may be found in the Notes to the Consolidated Financial Statements for the Year Ended 31 December 2014, in the section describing the subsidiaries and associates of Česká pojišťovna.

CP Strategic Investments N.V.

The end of 2012 was a time of restructuring, in which Generali PPF Holding’s operations in supplementary pension insurance and savings were concentrated within the Česká pojišťovna Group. Through CP Strategic Investments, Česká pojišťovna became the owner of Penzijní fond České pojišťovny a.s. and Generali Penzijní fond a.s. In spring 2013, the companies’ governing bodies signed a project on an internal merger by acquisition, effective as at 1 January 2013, with Generali penzijní společnost a.s. wound up as at the same date. In April 2014, Česká pojišťovna a.s. acquired the participating interest of a minor member to become the sole member of CP Strategic Investments N.V.

Penzijní společnost České pojišťovny, a.s.

Penzijní společnost České pojišťovny has long enjoyed leader status in the private pension savings sector in the Czech Republic. The company operates under the “third pension pillar” (supplementary pension savings), and since the beginning of 2013 – reflecting the pension reform introduced in the Czech Republic – it has offered products under the second pillar (pension savings).

At the end of 2014, the company was managing assets in excess of CZK 89 billion. Its profit last year stood at CZK 367 million. Taking the two pension pillars together, the pension company serves almost 1.3 million customers, with employers contributing to the pension plans of a quarter of a million of them.

Penzijní společnost České pojišťovny, through its extensive distribution network, reaches out to a wide range of customer segments. In addition to consultants and branches of the parent company Česká pojišťovna, the company also works closely with independent external networks of financial intermediaries, Czech Post (Česká pošta) and partner banks.

Generali Societate de Administrare a Fondurilor de Pensii Private S.A.

From the outset, Generali Societate de Administrare a Fondurilor de Pensii Private has been an active player in the compulsory supplementary pension insurance market that emerged following the reform of the Romanian pension system in 2007. It manages two funds, ARIPI and STABIL.

The ARIPI fund (compulsory supplementary pension insurance) is intended for customers aged 18 to 45 who are just entering the supplementary pension insurance system. The STABIL fund (voluntary supplementary pension insurance), on the other hand, is open to customers of all ages.

The ARIPI (“WINGS”) pension fund is the fifth largest pension fund in Romania with over 601,000 customers and EUR 361 million in funds under management (as at 31 December 2014).

ČP INVEST investiční společnost, a.s.

In 2014, ČP INVEST was the largest asset manager among all investment companies in the Czech Republic.

As at 31 December 2013, the aggregate equity of ČP INVEST’s 25 CZK-denominated mutual funds, one managed investment fund and Generali Invest CEE plc’s 10 sub-funds denominated in a variety of currencies (of which ČP INVEST is the sole distributor) exceeded CZK 25.7 billion. During 2014, customers invested a further more than CZK 6 billion in the funds managed by ČP INVEST and Generali Invest CEE plc.

Last year, ČP INVEST operated successfully in three countries – the Czech Republic, Slovakia and Poland, where it launched Trend 3, Trend 5 and Trend 8, new life-cycle products intended primarily for lump-sum investments. Within the space of six months, clients had invested over CZK 100 million in these products.

ČP INVEST Realitní uzavřený investiční fond a.s.

ČP INVEST Realitní uzavřený investiční fond a.s. is an internally managed investment fund of qualified investors. This fund’s assets are managed by the investment company ČP INVEST investiční společnost, a.s.

ČP INVEST Realitní uzavřený investiční fond a.s. focuses primarily on the real property market, investing in the stock of real estate companies. Additionally, the investment fund may invest in money market instruments, demand deposits, term deposits, government bonds, and receivables. The investment fund’s objective is to generate stable, long-term positive returns on the assets entrusted to it while achieving better liquidity, lower risk, and greater diversification than is possible when investing individually, and at the same time to maintain returns on investors’ funds above the level of interest rates offered by banks on medium-term deposits.

The investment fund’s total assets at the end of 2014 were CZK 2.3 billion, while its net asset value was CZK 2,290 million.

Česká pojišťovna ZDRAVÍ a.s.

Česká pojišťovna ZDRAVÍ a.s. (“ČP ZDRAVÍ”) is a 100% subsidiary of Česká pojišťovna a.s. Within the Group, ČP ZDRAVÍ focuses on a portfolio of insurance products associated with health, the provision of health care and customers’ hardship when they lose their source of income. For a number of years now, the product range has been closely interlinked with the products of the Holding’s other members in the Czech Republic. ČP ZDRAVÍ shares its sales network with its parent company, giving it access to the biggest network of sales locations and insurance intermediaries.

In 2014, ČP ZDRAVÍ posted gross premiums written of CZK 482.2 million, continuing the growth reported in the previous year. ČP ZDRAVÍ recorded its highest-ever net technical result (net of the transfer of investment returns) of CZK 114.4 million; gross earnings before taxation (CZK 120.3 million) once again exceeded the target.

ČP ZDRAVÍ’s strategic plan is to continue the positive trend in the key indicators of new business and economic results, while avoiding a hike in operating costs. In 2015, particular attention will continue to be paid to the health sector and the quest to identify opportunities for the creation of new insurance products designed to guarantee a superior standard of health and social care.

Cooperation will be maintained with selected public health insurance companies. The network of preferred healthcare facilities necessary to form a comprehensive range of insurance programmes for the provision of health care and professional medical assistance will be expanded.

Improvements in the attractiveness and quality of the range of supplemental products offered as riders to Česká pojišťovna’s core programmes will remain a priority. Another area of ČP ZDRAVÍ’s added value is its capacity to respond readily to evolving market conditions and to launch new insurance products and programmes in a remarkably short time.

ČP DIRECT, a.s.

ČP DIRECT is registered in the Register of Insurance Intermediaries maintained by the Czech National Bank as an insurance agent as defined by Section 7 of Act No 38/2004 on insurance intermediaries and independent loss adjusters and amending the Trading Act. The company is contractually authorised to act as an intermediary for Česká pojišťovna a.s.

In its operations as an insurance intermediary, ČP DIRECT focuses primarily on non-life insurance – motor damage insurance and motor third-party liability insurance in particular. To develop its business the company has built up a network of cooperating subordinate insurance agents, mostly automotive dealerships.

In 2014, the company posted total revenues of CZK 122 million and net after-tax earnings of CZK 1 million.

REFICOR s.r.o.

The company’s core business is servicing selected insurance receivables of Česká pojišťovna and coordinating activities related to their recovery, primarily through the courts, conducted by a law firm retained for this purpose.

As at 31 December 2014, REFICOR posted an after-tax profit of CZK 1.596 million.

Generali PPF Services a.s.1

Generali PPF Services has acted as a service company for Česká pojišťovna, Generali Pojišťovna and other members of the Generali PPF Holding Group since mid-2010, when the first agendas from both insurance companies were transferred to it. Subsequently, the shared-service strategy was gradually expanded to embrace the current range of services.

Generali PPF Services is registered in the Register of Insurance Intermediaries maintained by the Czech National Bank as an insurance agent as defined by Section 7 of Act No 38/2004, as well as in the Register of Independent Loss Adjusters maintained by the Czech National Bank as an independent loss adjuster as defined by Section 10 of Act No 38/2004 on insurance intermediaries and independent loss adjusters. The company has formed a contractual relationship with Česká pojišťovna a.s., under which it provides services covering the settlement of foreign claims, the handling of suspicious claims, the detection and investigation of fraud, the repair of road vehicle windscreens, the digitisation, indexing and archiving of documents, a mail registry and dispatch service, active telephone support, and a call service to make appointments between customers and sales staff. In 2014, the company built on its close cooperation with Penzijní společnost České pojišťovny in the intermediation of supplementary pension contracts.

Česká pojišťovna Foundation2

The foundation’s mission is to support the achievement of goals and aims, by individuals and legal entities, that are beneficial to the public or whose support is in the public interest, particularly in the arts, health care, sports, social affairs, and education. In 2014, the Česká pojišťovna Foundation sponsored several dozen cultural, sports, educational, preventive, safety and charity projects and activities.

1 In January 2015, this company was renamed the Generali Services CEE a.s.

2 In February 2015, this foundation was renamed the GCP Foundation (Nadace GCP).